-

Coursera: It’s Now More Reasonably Priced

– Updates from our previous sell recommendation seen on Seeking Alpha (63.22% gain)

Review

Image from: https://satbayev.university/en/news/top-7-courses-at-coursera We first covered Coursera (NYSE: COUR) in “Coursera: The Bottom Could Be Near” on Seeking Alpha in December 2022 with a hold rating when the stock was at $13.92. The stock first declined 21% in the next four months and subsequently rallied by a bit more than 100% peak-to-trough reaching as high as $20.65 by December last year. We wrote the second coverage on the company in January this year in “Coursera: Great Improvement But Valuation Highly Stretched” when the stock was at $19.55 with a sell rating. Both of the past two articles on the stock were built on the thesis of analyzing Coursera’s cost structure along with its rapid growth concluding that the scalability is limited for the company to capture the growing job market demand in its related course offering. Although bullish about its long-term potential, we were more realistic about its growth rate. Since then, it has declined by 63.22% to now $7.17, falling to the price in our bearish case scenario. We want to look at the updates of the company and see what action could be taken for the stock.

Updates

In the most recent quarterly earnings released on May 2nd, Coursera reported a beat of normalized actual EPS of $0.07, beating by $0.06, and revenue missed by $1.3 million compared to consensus but still marked a 14.5% growth YoY. The company’s GAAP actual EPS was still negative at $0.14, but a beat by $0.03. On a TTM basis, its GAAP actual EPS is at its best it has been.

Despite beating the consensus expectation, the company set a cautious tone in its anticipation of slower-than-expected AI adoption in the workplace and job creation, which could drag down its revenue growth in the near term.

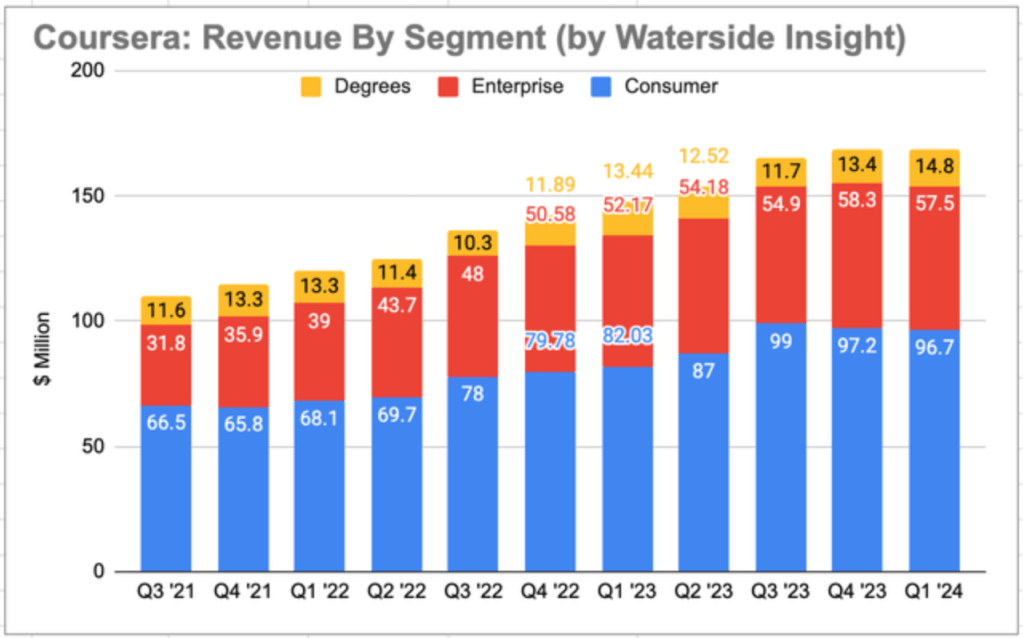

Two quarterly reports have been released since our previous article was published in January. From the updated chart below, the trend shows Coursera’s top-line growth has flattened in the past two quarters, due to a slight decrease in its two largest segments, Enterprise and Consumer, while the smaller segment, Degrees, had a small increase.

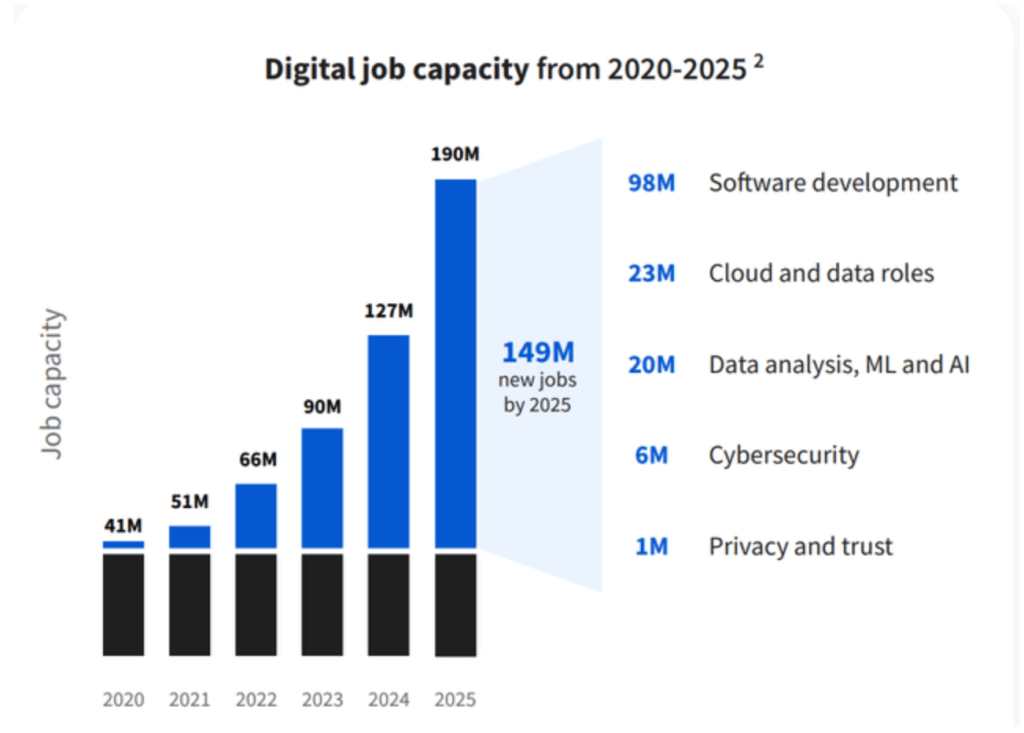

Coursera: Revenue by Segment, Calculated and Charted by Waterside Insight with data from the company According to Coursera’s presentation material, the number of digital jobs increased by 29% YoY in 2022 and 36% YoY in 2023, will grow by 41% YoY in 2024, and again by 49% in 2025. And the company is set out to capture this growing pie.

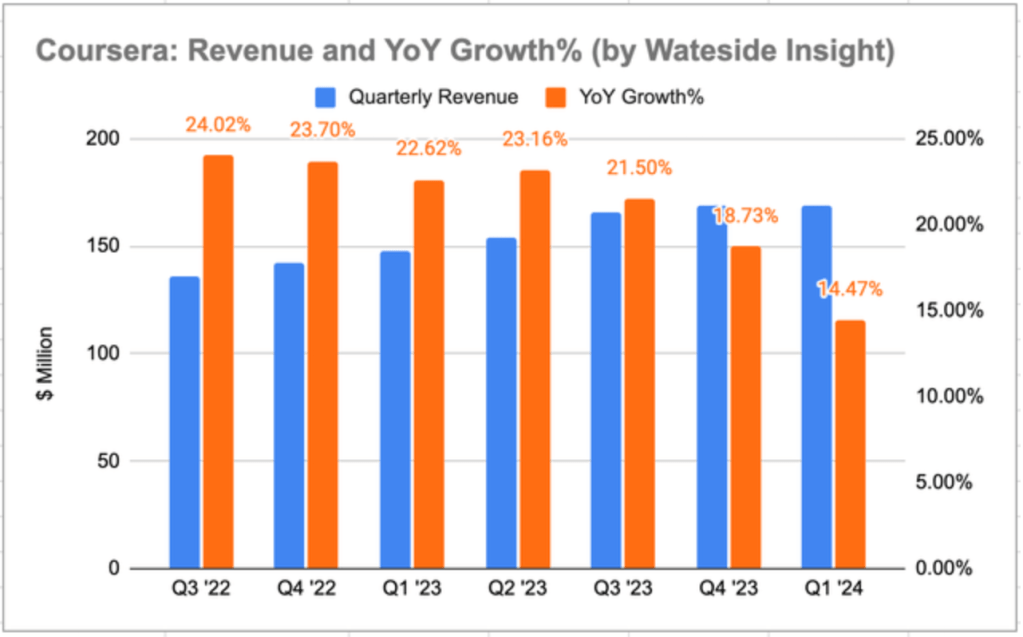

Digital job capacity from 2020-2025 (Coursera Quarterly Presentation) In comparison, its revenue growth rate isn’t keep pace with this presumable rapid growth. Before Q3 of 2023, the growth rate was above 20%, but in the past two quarters, it has dropped to the mid-teens. Perhaps one of the reasons was the layoffs in the tech sector in 2023, which continued into earlier this year.

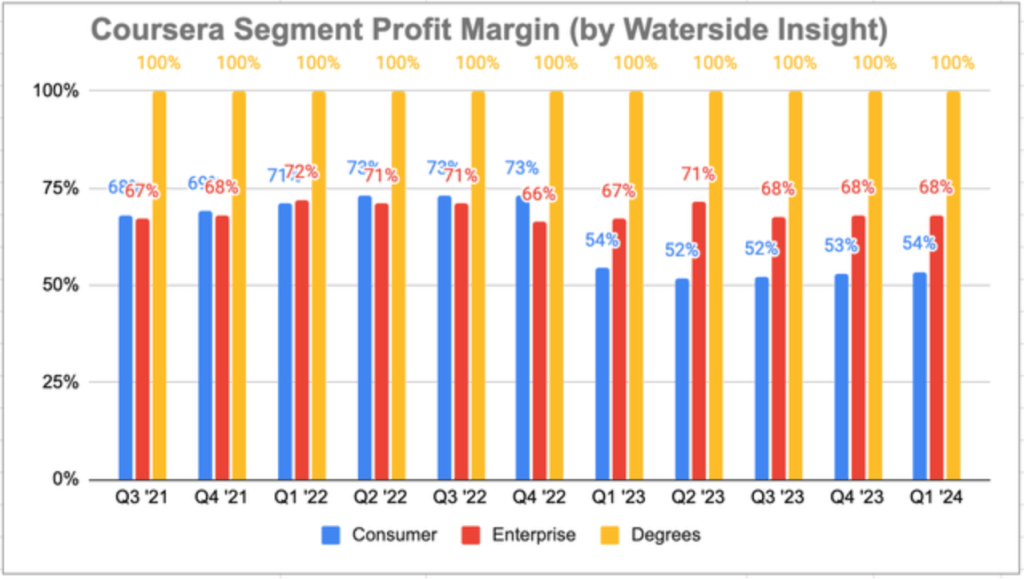

Coursera: Revenue and YoY Growth % (Calculated and charted by Waterside Insight with data from the company) Equally stagnant was its profits margin per segment. We previously cautioned investors that the Consumer segment’s development might give a more accurate reflection of Coursera’s scale-up cost, which could increase proportionately with the expansion and cause the margin to be suppressed. Since ramping up the expansion of this segment in Q1 of 2023, when the Consumer segment’s margin dropped from 73% to 54%, its total revenue has since increased by 14.47% but each segment’s margin had little improvement.

Subscribe to get access

Read more of this content when you subscribe today.

Coursera: Segment Profit Margin (Calculated and charted by Waterside Insight with data from company) As we recommended before, Coursera’s best course of action to improve margin will be to focus on the applicability of its offerings in Enterprise and Degrees segments. Indeed, the company announced in January that it has exclusivity hosting twelve Google (GOOG) and IBM(IBM) professional certificates that have received FIBAA certification. Its CEO saw these micro-credential courses to be best fitted with university degree offerings as “career electives”, which will strengthen its Degrees segment.

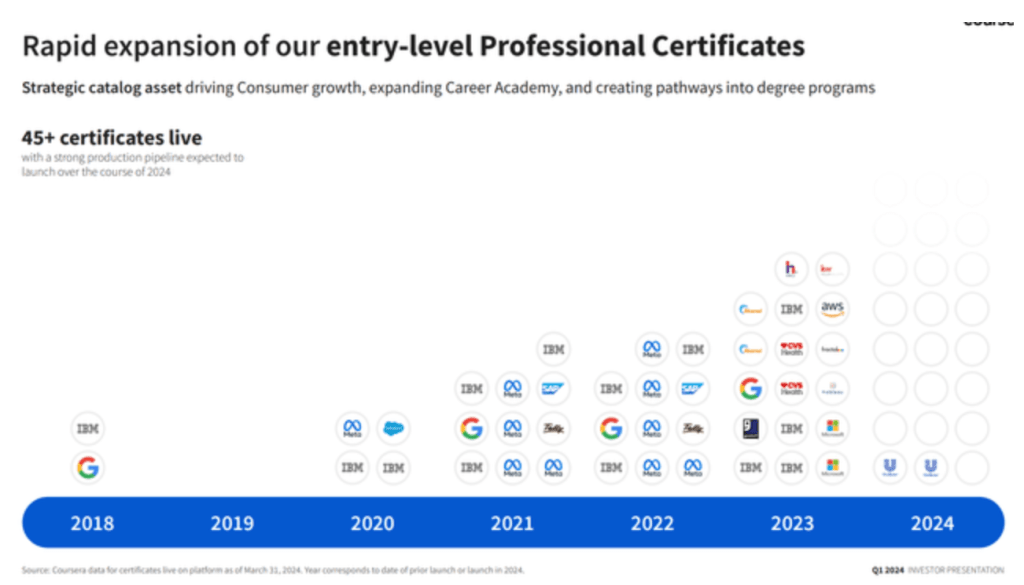

Looking ahead at its pipeline, Coursera is expected to continue developing rapidly in entry-level certificates in business administration, data analytics, and computer science & engineering. Still, most of these jobs will be created as the derivatives of overall economic expansion.

Coursera: Rapid Expansion of Its Entry-Level Professional Certificates (Coursera Quarterly Presentation) Now with its revenue growth stagnant, the question is whether it will need to make another expansion of the Consumer segment, which will involve the increased cost of revenue and lower margin once again. We think the fundamental issue here is tech sector expansion doesn’t happen in a vacuum but follows the economic growth cycles. With the economy adjusting to the interest rate and inflation environments, the tech sector’s growth also went into a soft patch. On top of this, the scalability of Coursera’s growth is not unlimited, or at least not as high as the market has priced in. As we previously analyzed, the Consumer segment is likely to blunt the true cost of new material development, while the Enterprise segment bears some repackaging cost, and only the smallest segment, the Degrees, is completely cost-free as it refitted the materials developed in the other two segments into the university curriculum. So when a stagnant margin in the Consumer segment coincided with flattened revenue growth, the lofty premium in the price quickly deflated along with stretched expectation, as we expected it would be back in January.

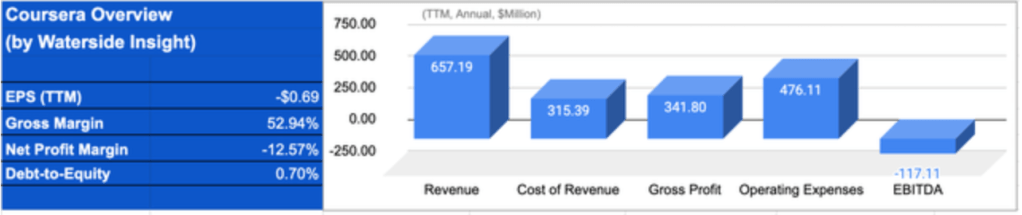

Financial Overview & Valuation

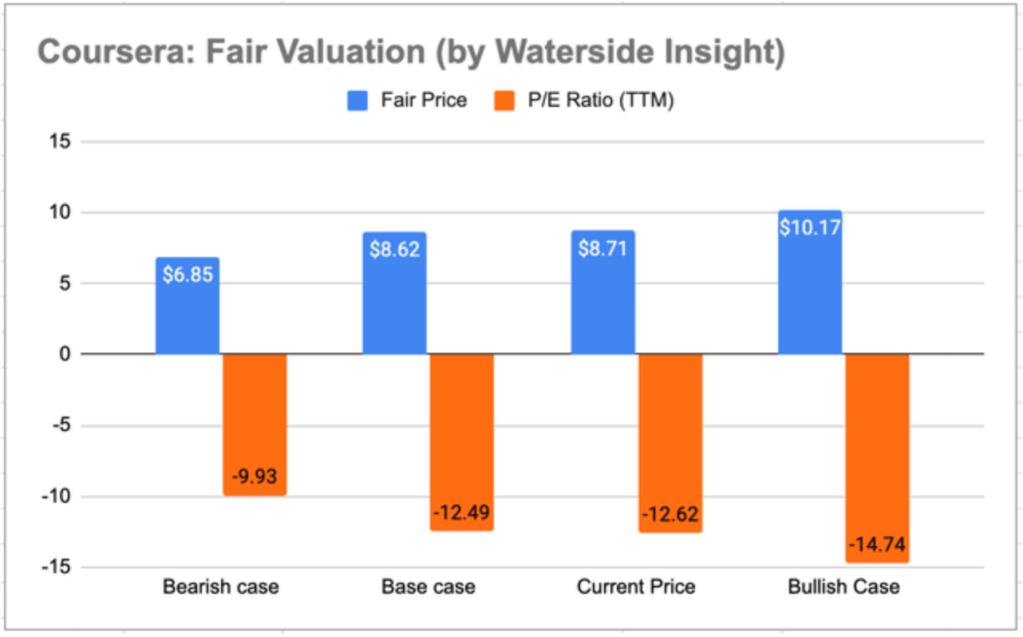

Coursera: Financial Overview (Calculated and charted by Waterside Insight with data from the company) After the 63.2% decline in its stock price in the past four months, Coursera is now at or close to our base case scenario. For readers that have read our previous two articles covering the company, it would be more clear that we evaluate both its growth and costs when pricing its stock. It’s a better way to look at the company simply because it’s more realistic and doesn’t get caught up with the lofty goal it set out to achieve. The path toward achieving that goal matters to investors as well. Although the company is achieving positive free cash flow two quarters earlier than we anticipated, the slow-down top-line growth momentum also came earlier than expected. Factoring in the company’s guidance for the rest of the year, its fair price should at our base case scenario. Our fair valuation below shows different price targets based on your view. If you are bullish on the stock, there would be more upside to come.

Coursera: Fair Valuation (Calculated and charted by Waterside Insight with data from the company) The risk to our valuation is if the top-line growth rate continues to decline, its fair price could hover around the base case scenario for longer if not lower. We are by no means bearish on its long-term growth. Although there needs to be more visibility of another strong momentum, the current market price suggested the stock is undervalued.

Conclusion

We reviewed our previous sell thesis set in January this year which has materialized four months later with a 55% decline since then. The thesis is still valid at this point given the soft patch the company is going through against the persistent costs associated with it. Although most financial metrics are heading in the right direction, they don’t warrant a rich premium over the current price. We recommend to buy Coursera at or below $7 currently.Disclaimer: This article does not constitute investment or other advice. It is neither an offer to sell nor a solicitation of an offer to buy any securities. We do not hold position in the securities recommended. Past performance is no guarantee as to its performance in the future. This article is not an advertisement and is not intended for public use or distribution. To quote this article for your personal or professional usage, please credit “Waterside Insight” and use the following link: https://wordpress.com/post/watersideinsight.com/50

-

About

We are data-oriented analysts with over 20 years of investment experience in stocks, fixed income, forex, cryptocurrency, commodities futures, and options with success. With our unique approach, we provide independent opinions and insights focused on discovering medium-term investment opportunities.

-

WATERSIDE iNSIGHT

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.